san mateo county tax collector property tax

The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. All appeals must be filed with the Clerk of the Board of Supervisors at the County Government Center.

Property Taxes Due Monday In San Mateo County Sf Deadline In Flux

Announcements footer toggle 2019 2022 Grant Street Group.

. SMFCSD MEASURE B 1991. San Mateo Uhsd Bond. However they are still required.

Search and Pay Property Tax. Make Tax Checks Payable to. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes.

San Mateo County TreasurerTax Collector Sandie Arnott an elected official is charged with managing and protecting the Countys financial assets. For questions or problems making online. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County.

The Tax Collectors Office is open to the public from 900 AM - 500 PM Monday through Friday. Mail Tax Payments to. With approximately 237000 assessments each year.

The State Board of Equalization developed a. If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which. CITY OF SM SEWER.

The Property Tax Highlights publication includes information on the following. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022.

Redwood City CA 94063. Direct Charges and Special Assessments. For more information call 6503634573.

Sandie Arnott San Mateo County Tax Collector. Every year the Tax Collector mails the secured tax bills by November 1. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov.

First Installments of 202223 Annual Secured Property Tax Bills are due as of November 1st. San Mateo County Tax Collector PO Box 45878 San Francisco CA 94145-0878. If you did not receive a bill or if you recently purchased a property you may obtain a duplicate tax bill by calling 866.

She acts as the banker. San Mateo County Tax Collector 555 County Center Redwood City CA 94063. Generally property is assessed at the lesser of two values.

San Mateo County collects on average 056 of a propertys. Search and Pay Business License. Search and Pay Property Tax.

Tax payments are mailed to the. The law provides property tax relief to property owners if the value of their property falls below its assessed value. Pay Taxes or Obtain Tax Bill.

Search and Pay Business License. 2019 2022 Grant Street Group. A summary of the property tax process in San Mateo County.

Masks are optional for visitors of County facilities but are. The first installment of the 202223 Annual Secured Property Tax Bill is due November 1st and will. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less.

For more information please visit the San Mateo County Tax Collectors. 555 County Center - 1st Floor.

San Mateo County Tax Collector Secured Tax Due Date Reminders

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

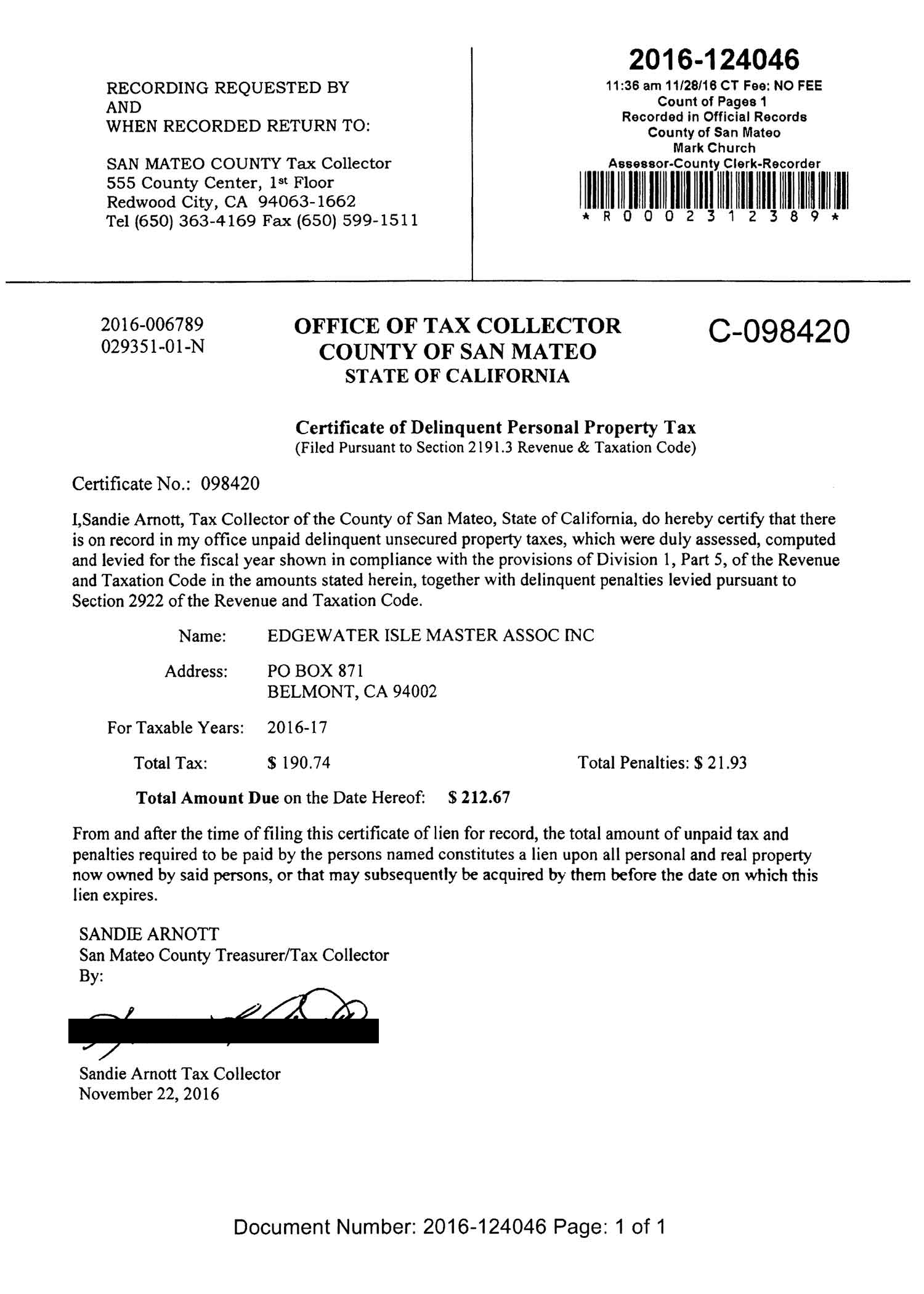

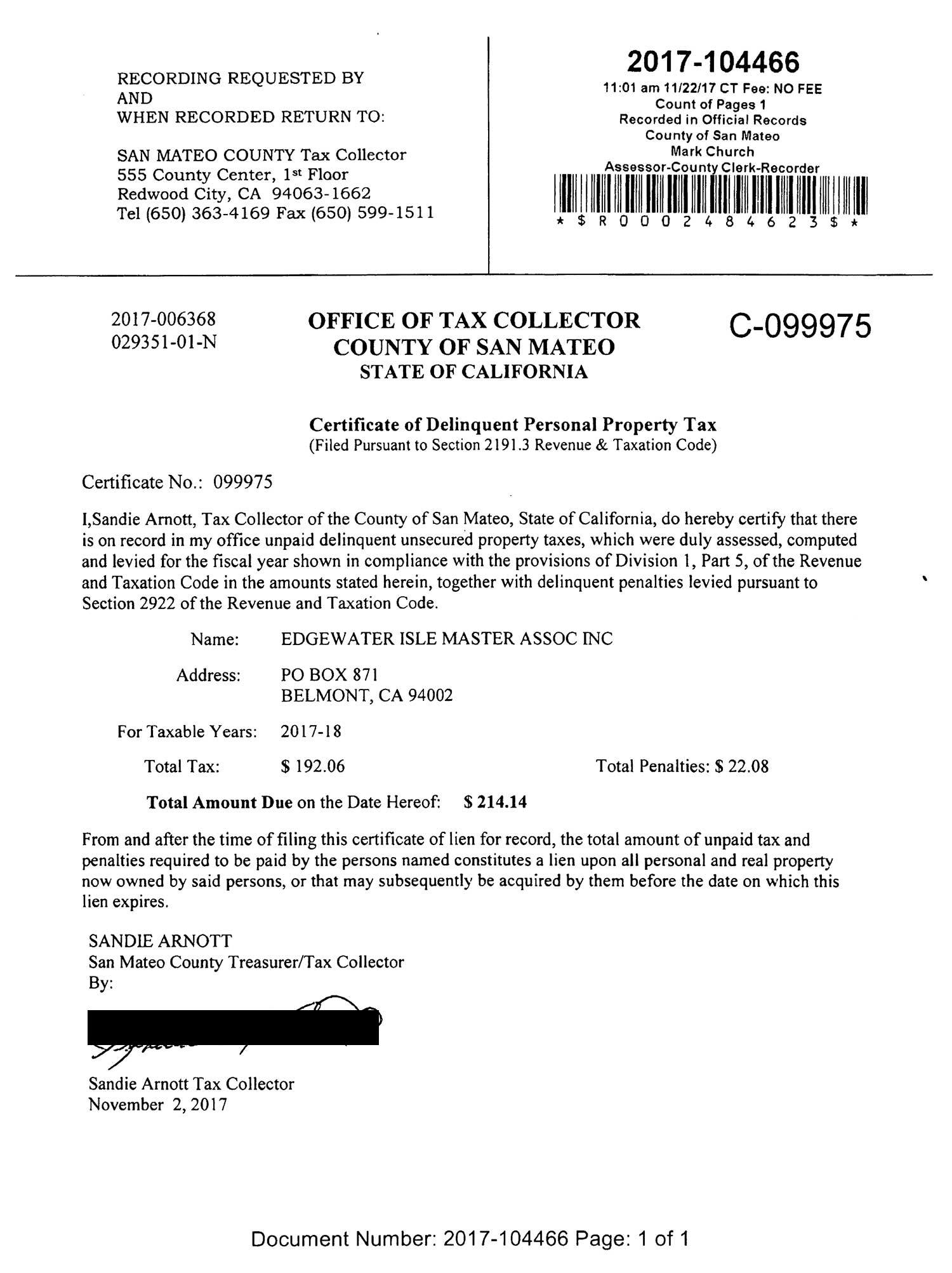

San Mateo County Issues Liens Against Master Association

San Mateo County Ca Property Tax Search And Records Propertyshark

Property Taxes Due Monday In San Mateo County Sf Deadline In Flux

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

County Of San Mateo Government Now That The Property Tax Bill Deadline Is Behind Us Did You Know That You Can Find All Of The County S Property Tax Data By

Property Tax Deadline Extended In San Mateo County News Almanac Online

Ouch It S Time To Pay The Property Tax Half Moon Bay Ca Patch

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Understanding California S Property Taxes

Property Tax Deadlines Andy Real Estate

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

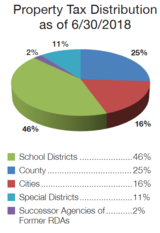

Where Do My Taxes Go County Of San Mateo Ca

County Of San Mateo Government Quick Tip Tuesday Some Santa Clara County Taxpayers Reported Receiving Bogus Letters Like The One Pictured In This Post From A Non Existent Tax Lien Office

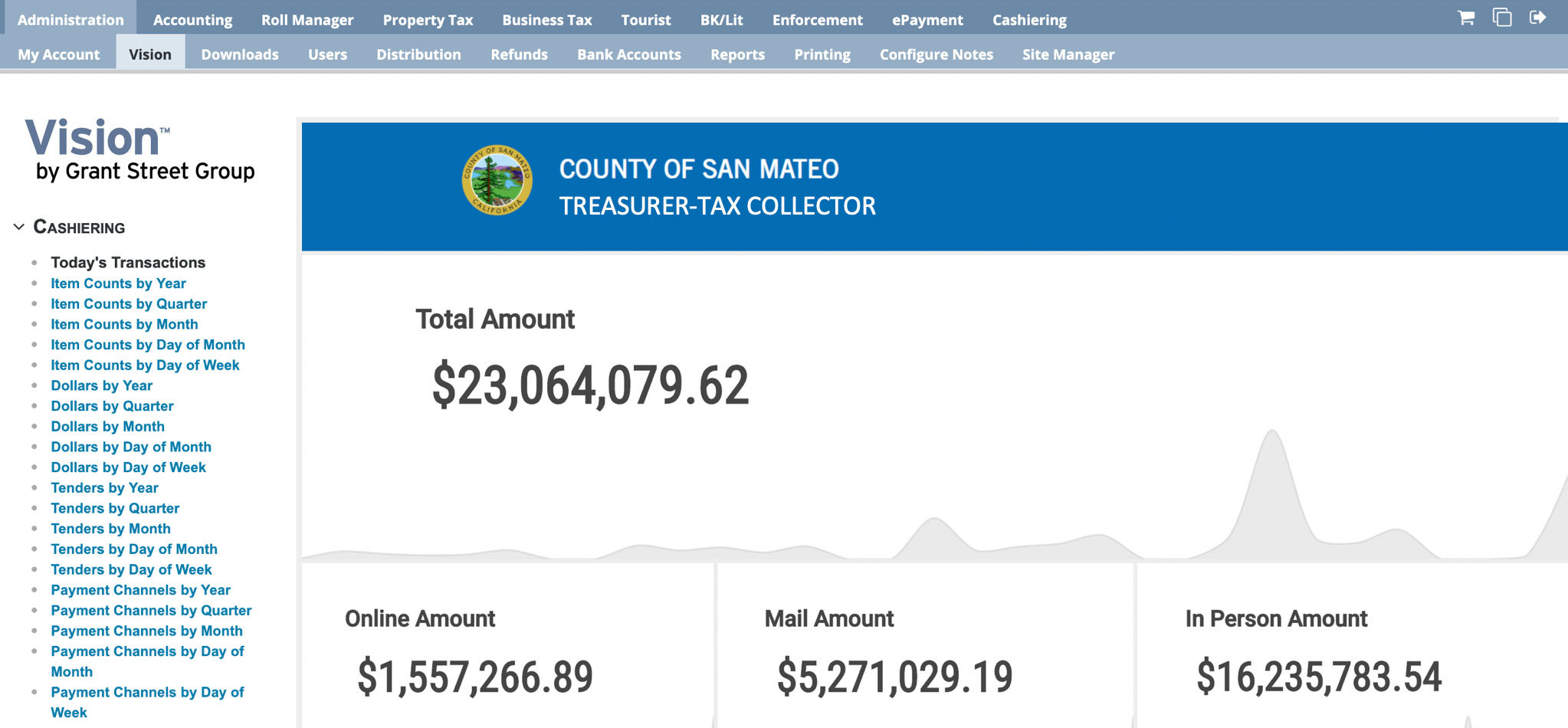

San Mateo County Ca Goes Live With Taxsys Business Wire

Sandie Arnott For Treasurer Tax Collector 2022 Pretty Proud Facebook