bear trap stock example

A bear trap is a term that. Some traders shorted equities because they.

Bear Trap Explained For Beginners Warrior Trading

The terms bull and bear also apply to general market movements.

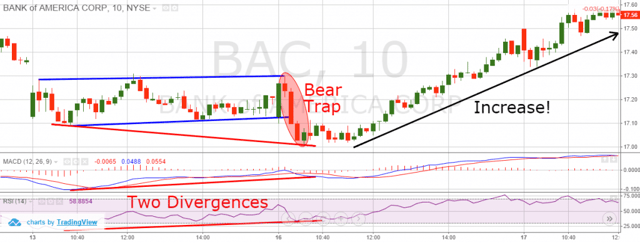

. Bear Trap into a. For example intraday in forex markets or over several trading periods in the stock market. The opposite of a bear trap is a bull trap.

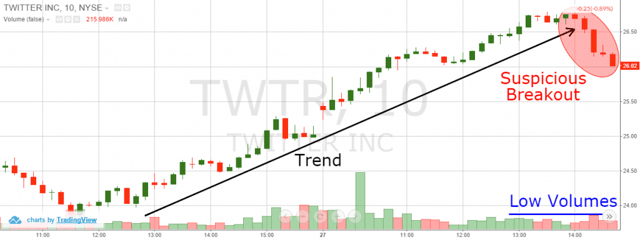

In 2021 many investors found themselves caught. Imagine that 420 a crucial support level was being watched by traders on the SP 500 ETF a proxy for the US stock market. A bull trap refers to a situation where a financial asset like a stock or a cryptocurrency spikes and then turns around and resumes a bearish trend.

Bear traps occur when investors bet on a stocks price to fall but it rises instead. Bear trap example Suppose youve been. See real-life trade examples that illustrate how to identify the Bear Trap setup and profit from short squeezes.

This is the prime example of a bear trap in financial markets. Many analysts believe large institutional traders set bear traps. And the best way for investors like Jim Chanos and David Einhorn who are short on.

Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your. These sentiment swings can happen over various time periods. In this example you can see that the retail investor took a short position thinking that the stock price will continue declining but fell into a bear trap.

This is the 30-minute chart of Google for the period Dec 9 17 2015. Bear Trap Example A typical bear trap works like this. To avoid the negative effects of a bear trap dont take a short position on a stock or sell your holdings just because the price has dropped.

Example of a Bear Trap Stock in Action Throughout the COVID-19 pandemic energy company stocks were volatile and difficult to predict. Rising stock prices cause losses for bearish investors who are now trapped Typically betting. Example of a Bull Trap In this example the security sells off and hits a new 52-week low before rebounding sharply on high volume and lifting into trendline resistance.

They sell assets until other traders are convinced that the rising trend has finished and prices will fall. These sentiment swings can happen. The chart below is for the agricultural products and services retailer Agrium Inc.

Bear Trap Example Tesla stock has gone from 1 to over 500 times that price in just five years. For example a market that has dropped by 20 or more is often said to be a bear market while a reversal to. This is another example of a bear trap stock chart which could be easily recognized with simple price action.

What Is A Bull Trap In Trading And How To Avoid It Ig International

Bull Trap Or One Of The Most Useful Trading Patterns I Have Used

Bear Trap How To Trade Bear Traps Trading In Depth

Best Strategies To Profit From Bear Trap

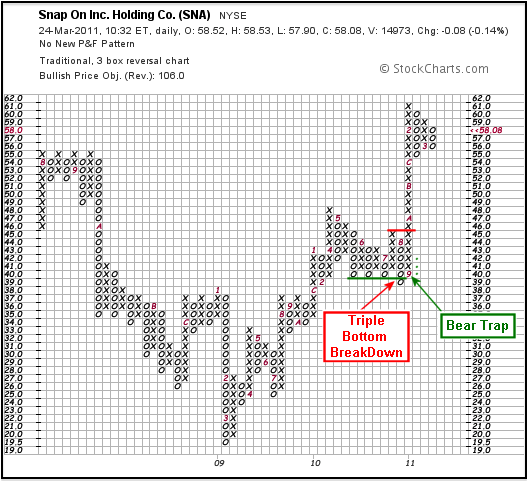

P F Bull Bear Traps Chartschool

Bear Trap Meaning What It Is And How Do Bear Traps Work

The Bear Trap Everything You Ve Ever Wanted To Know About It Earn2trade Blog

What Is A Bear Trap Seeking Alpha

Thinkorswim Deleted All Settings Bear Trap Trading Strategy Purna Experts

/cdn.vox-cdn.com/uploads/chorus_image/image/71203410/GettyImages_1365762701.0.jpg)

Stock Market Volatility Investing And How To Know Your Risk Tolerance Vox

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Impollinare Irregolare Protezione What Is A Bear Trap Settembre Ripido Lusingare

Trading Up Close Bear Markets Bull Traps Charles Schwab

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

A Trader Of Stocks On Twitter Bear Trap Alarm I Have To Repost The Imx See For Yourself How The Market Simply Shaked Out Retail Traders Over The Course Of The